About Home Loan Interest Certificate If you have taken home loan, you are eligible for home loan interest exemption up to Rs 2 Lakhs. Even the home loan principal can be claimed u/s 80c exemption up to Rs 1.5 Lakhs in a financial year. IT and Provision Certificate. Certificate / Loan Statement. To access your loan account, please fill in all the details and click Submit. Cust ID: Loan Account Number: Date of Birth (DD-MM-YYYY): PAN No: Notes: i) Please note that all the four fields are mandatory for login into the application.

An interest certificate is important to show the interest either credited or debited from your bank account. We need this to complete our filing of the income tax returns. In today’s article, I will be telling you the steps which you need to follow to get interest certificate from IDFC First Bank. You can even obtain the interest certificate offline. For that, you will have to visit your home branch personally or the branch from where you have taken the loan. But let me tell you that IDFC First Bank is always working on making things better for the account holders.

Certificate of Interest The Bank automatically sends out an Annual Interest Summary at the end of each tax year, which details the interest credited and any tax paid. You can use this to complete your tax return and you do not need a certificate of interest for this purpose. Interest certificates, just like TDS certificates, are issued at the end of the financial year for the given financial year only or even for years preceding that. Interest certificates on the Fixed Deposits opened in a bank can be obtained by submission of a written request in a letter at the bank's branch office. The Federal Reserve's interest rates decisions can impact the rates that banks offer on CDs. When the Fed raises or lowers the federal funds rate, banks typically respond by moving savings.

And they have provided us with an option to get the interest certificate online. I will be telling you the online procedure to get the interest certificate from the IDFC First Bank using internet banking. To follow this guide you will need access to your internet banking account. If you don’t have access then you will first have to activate the internet banking feature for your bank account. All you need to do is go to the official website of the bank and get your customer ID activated and you will be good to go.

I will assure you that after reading this article you will be able to get interest certificate from IDFC First Bank within a few minutes. But before we proceed to the further part of this article. I would like to brief you about the bank where you hold your bank account. These days it is very important to know about the bank where you have deposited all your hard-earned money.

Contents

About IDFC First Bank

| Type of the Bank | Private Bank |

| Traded As | BSE: 539437 NSE: IDFCFIRSTB |

| Industry | Banking and Financial Services |

| Predecessor | IDFC Bank and Capital First Limited |

| Founded | October 2015 |

| Head Quarters | Mumbai, Maharashtra |

| Chairman (January 2020) | Rajiv Lall |

| MD and CEO (January 2020) | Mr. V. Vaidyanathan |

| Products | Consumer banking, Corporate banking, Wholesale banking, Mortgage loans, Private banking, Wealth management, Investment banking |

| Revenue (2017) | ₹85.3272 billion |

| Operating Income (2017) | ₹30.30 billion |

| Net Income (2017) | ₹10.20 billion |

| Total Assets | ₹1.12160 trillion |

| Number of Employees (July 2018) | 7,043 |

| Website | www.idfcfirstbank.com |

| Customer Care Phone Number (toll-free) | 1800 419 4332 |

| Customer Care E-Mail ID | [email protected] |

How to Get Interest Certificate from IDFC First Bank?

The steps are very simple, I have mentioned all the steps below. One important thing you should note and that is the bank will never call you to ask your username, password, OTP, ATM PIN Number, CVV, etc. If you ever get a call or email asking for details like this then you should never respond to them.

And when you are using internet banking, make sure that you are entering your username and password only on the official website. If you feel the website is not officially owned by the bank, then you should not enter your details.

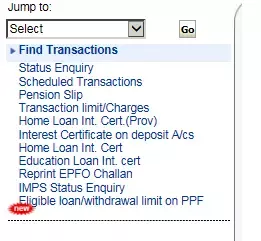

- Go to the official website of the IDFC First Bank.

- Click on Customer Login.

- Click on Personal and Business Banking.

- Enter your IDFC Bank Internet Banking Username and Password.

- Click on Service Requests.

- Click on Create.

- Click on Interest Certificate.

- Select the Financial Year from the drop-down menu.

- Click on Download Certificate to download.

If you wish to get the interest certificate delivered to you via E-mail then you can get it by selecting the same in the 9th step.

Conclusion

This is how you can download or get interest certificate from IDFC First Bank. I hope you are clear with all the information mentioned in this article. If you have any kind of doubts in your mind then you can comment down below. I will be more than happy to help you out with your banking needs. And in case you want to get assisted quickly then you can call the customer care of the bank on their toll-free number: and talk to the customer care executive.

Can I get the Interest Certificate Online?

Yes, you can get the interest certificate from the IDFC First Bank online using the internet banking feature. Just go to the official website of the bank and use your credentials to login to your bank account. Once done follow the 9 mentioned steps in this article.

Can I use Mobile Banking application to get the interest certicate?

No, currently as on 22/03/2020 there is no option in the mobile banking application of the IDFC First Bank which can help you to get the interest certificate.

Can I get the Interest Certificate for the Previous Year?

Interest Certificate Hdfc

Yes, you can get the interest certificate of the previous year by following the steps mentioned in the article.

Are there any charges to Issue the Interest Certificate?

No, you will not be charged anything to issue the certificate. It is free of cost.

Can I get Interest Certificate Online without using Internet Banking?

No, there is no other means to get the interest certificate online without using internet banking. You must log in to your internet banking account to get it.

To,

The Branch Manager,

_____________ (Bank Name),

_____________ (Branch Name/ Address)

Date: __/__/____ (Date)

Subject: Request for home loan interest certificate.

Respected Sir/Madam,

Respectfully, my name is ____________ (Name) and I am a _____________ (Mention home loan account details) account holder in your branch for the last _________ (Duration) months/ years.

I am writing this letter to request you to kindly issue me Home Loan account statement of my ________ (type of loan account) account number from __/__/_____ to __/__/____ (date) or Financial year ___________ (FY) or till date. I want my loan statement for __________ (income tax/personal/any other reason).

Following are details of my loan:

Loan Number: _______________

Account Number: _______________

Loan Tenor: _______________

Therefore, I request you to kindly issue a loan interest certificate as that would be needed in the __________ (purpose). I shall be highly obliged.

Thanking you

Yours Truly,

__________ (Signature),

__________ (Name),

__________ (Contact Number)

Similar Search Results:

Certificate Interest Rate

- letter to bank requesting for home loan interest certificate

- sample letter to the bank asking for home loan interest certificate